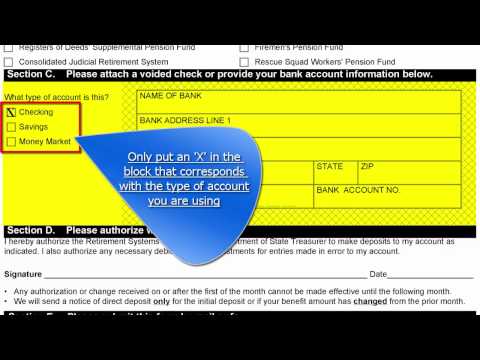

Hello, I'm Staff Sergeant Travis Reed, and today I'm going to guide you through how to fill out the state direct deposit form, which is simply Form 170. This is the direct deposit form, Form 170. It is fairly simple, but we will go over it section by section. In Section 8, you will provide your first name, middle initial, and last name. To the far right, you have your SSN, which stands for Social Security number. You can enter it with or without the dashes. The next line is for your mailing address. This is the address where you will receive your mail, whether it is a physical address or a PO . To the right, you have "Member ID," which should be left blank. On the following line, you need to provide your city, state, zip code, telephone number, and date of birth. In Section B, you will choose the "National Guard Pension Fund," even if you receive more than one state retirement. For this form, you will only fill out the National Guard Pension Fund. In Section C, you will indicate the type of account you have, whether it is a checking, savings, or money market account. To the right, you can provide your bank information. At this point, you have two options. You can either attach a check to this section and not fill in any information, or you can handwrite all the necessary bank information. For this example, we'll use the State Employees Credit Union as the bank. The next line will be the bank address, followed by the bank address line 2 if necessary. Then, provide the city, state, and zip code of the bank. Below that, you need to enter your bank routing number and account number. Make sure your bank routing number has 9 digits, as every...

Award-winning PDF software

Dd 108 continuation sheet Form: What You Should Know

Military Retirement — Video Retirement is more than a pension — it can add years of education, additional training, or additional pay into your life. In fact, there are two versions of a retirement pension available to you and your spouse. If you choose a non-traditional type of pension that does not provide you with the full retirement pay (as of January 1, 2012, or a reduced retirement pay level after you reach normal retirement age of 62 or 67), it's important to keep all receipts related to the payment and the cost. If you fail to properly maintain your paperwork, you can be fined by the government. You'll have to include Form 1099-MISC for the monthly pension payment with most payroll processors. If you pay the monthly pension yourself, you'll save a lot of time on receipts and paperwork and your spouse can do his/her own tax reporting at his/her own discretion. The basic military pensions are calculated differently, although the pay rates would be the same, but there is an additional cost: a retirement home expense deduction and a cost for the education, healthcare, and transportation, including the cost of housing, the mileage, and insurance for the member. You'll need to calculate the total expenses and subtract them from the basic monthly compensation payable. Military Retirement — YouTube 1099-MISC — This is your federal income tax withholding (or 1099) form. This is part of the money you may receive in pay as compensation. If you pay money into your own IRA, it's called a “payroll deduction” and is reported on Form 8606 (IRS Employer Withholding Instructions), which the Pay Specialist and your payroll supervisor can assist you with. The IRS has a complete list of all payroll deductions. If you are eligible for a pension, this is part of the “Pension and Survivor'' part of the income taxes. Retirement Benefits You will receive a basic military retirement pay, which includes both a fixed and a variable amount as well as a maximum benefit amount. Both the fixed and variable amounts of basic military retirement pay may change depending on when you begin and when you complete your service. The variable amount is the amount you will receive upon completion of your military service. You are eligible to receive this amount based on: the age of your entry into the Armed Forces.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 108, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 108 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 108 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 108 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 108 continuation sheet